pay indiana state property taxes online

MAIL Remit Payment to Bartholomew County Treasurer PO Box 1986 Columbus IN 47202. The Indiana Department of Revenue does not handle property taxes.

Postmarked by due date to be considered on time 2.

. Building A 2nd Floor 2293 N. E-Check Visa Mastercard Discover and American Express accepted. Learn more about property tax in Henry County.

Main Street Crown Point IN 46307 Phone. If you have an account or would like to create one or if you. Know when I will receive my tax refund.

Court House 101 S Main Street New Castle IN 47362 Justice Center 1215 Race Street. In Indiana aircraft are subject to. South Bend IN 46634-4758.

Cookies are required to use this site. Main Street Crown Point IN 46307 Phone. Find Indiana tax forms.

Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability. If requesting a receipt please include a self-addressed. To pay your bill by mail please send your payment to.

If payment is made after the tax due dates contact the. 800AM400PM Saturday Sunday Legal Holidays. Pay Your Property Taxes.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. There are several ways to pay property taxes online in Bloomington Indiana. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Online Payments - Visa MasterCard American Express or Discover credit cards debit cards. Property Tax Bill Payment Options Deadline May 10 2022-Mail check and tax coupon to 555 Michigan Ave Ste 102 LaPorte IN 46350 if you would like a receipt please include a self. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more.

Homeowners can pay by credit card debit card or electronic check. Quick Links 2022 General Election DEPARTMENT PHONE LIST Employment Opportunities Pay Traffic Citation Pay Court Fines and Fees Warrant Search Court Date Lookup Pay Property Tax. Failure to receive a tax statement does not relieve the taxpayer of the responsibility for payment and penalties when delinquent.

20 N 3rd Street. Call 855-423-9335 with questions. Your browser appears to have cookies disabled.

Please direct all questions and form requests to the above agency. Credit card and debit card.

Tax Claim Indiana County Pennsylvania

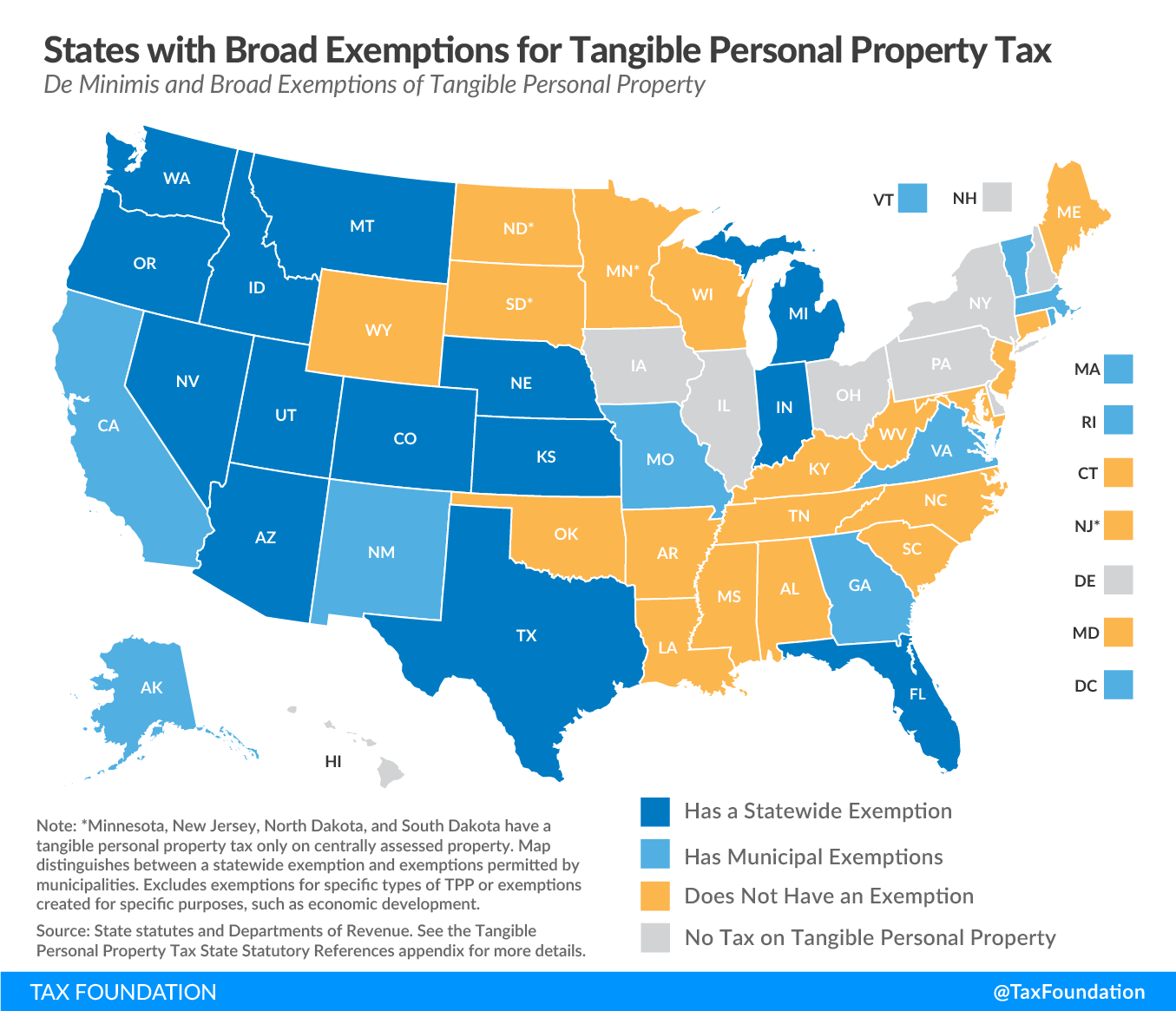

Tangible Personal Property State Tangible Personal Property Taxes

Treasurer Johnson County Indiana

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Business Personal Property Tax How To Maximize Your Efficiency

Fillable Online Indygov Indiana Property Tax Benefits State Form 51781 R2 106 R3 506 Prescribed By The Department Of Local Government Finance Instructions This Form Must Be Printed On Gold Or

Pennsylvania Property Tax H R Block

Floyd County Indiana Treasurer S Office

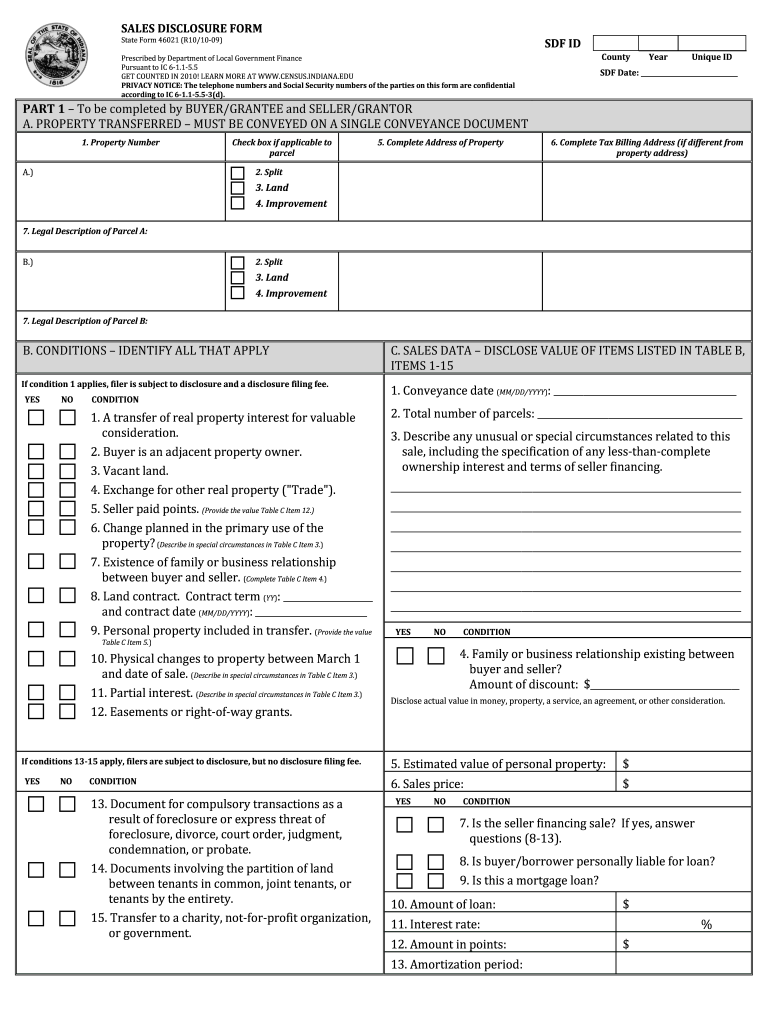

State Form 46021 Fill Out Sign Online Dochub

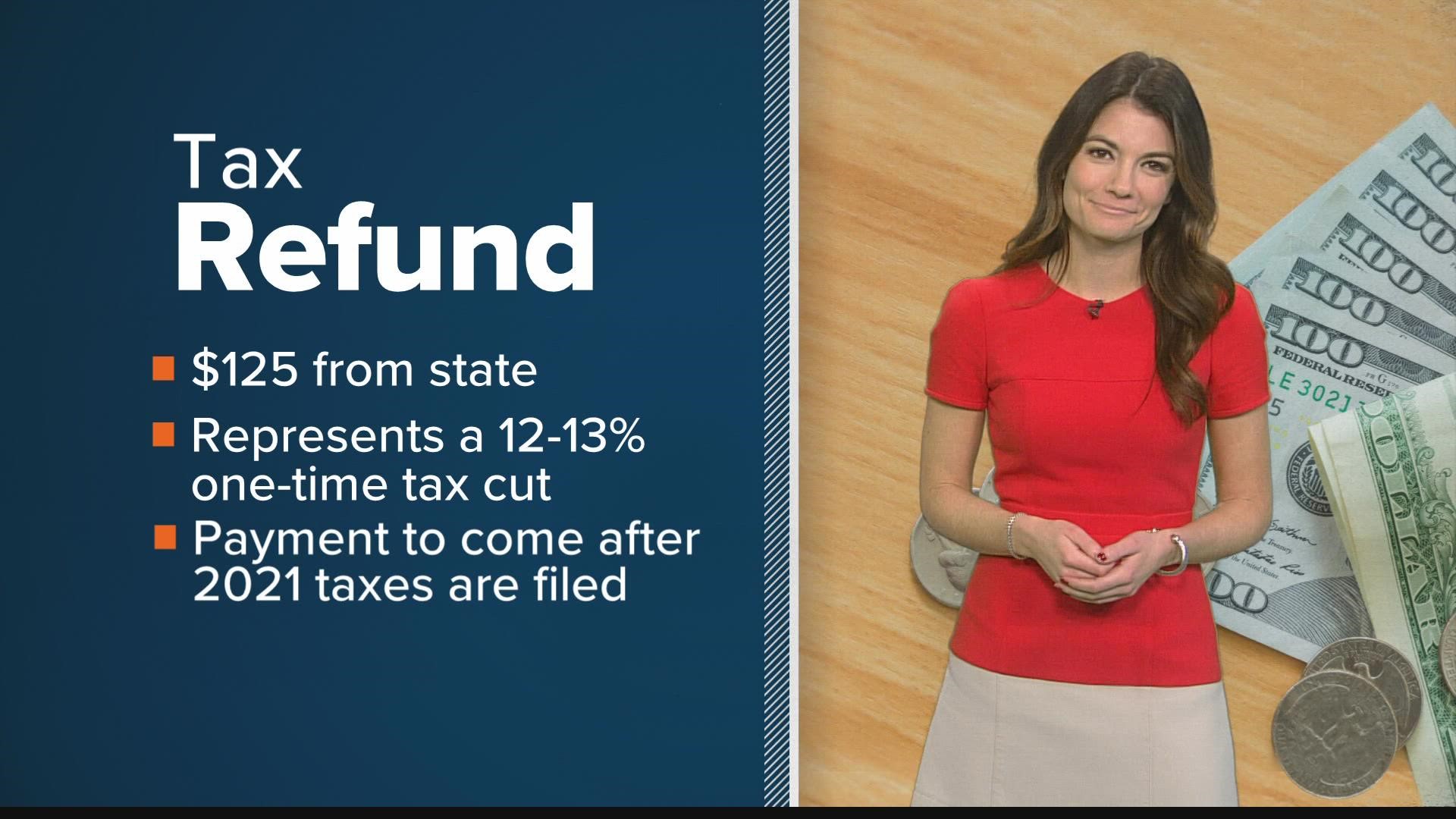

Bonus 125 Refund Coming To Indiana Taxpayers But Not Quite Yet Wthr Com

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Taxes In The United States Wikipedia

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax How To Calculate Local Considerations

2022 Property Taxes By State Report Propertyshark

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis